We all like to remember our successes and forget our failures, and finance is no different. As investors’ inboxes once again become clogged with annual outlooks from Wall Street’s scribblers, there is little admission of the nearly universal failure to predict what happened this year—even though the things the analysts missed are much more interesting than their forecasts.

There are two big lessons to learn from the mistakes of the year-end crystal-ball gazing. The first is that when everyone agrees that prices can only go in one direction, it is dangerous. The second is more nuanced: We really know an awful lot less about how the economy works than we thought.

Last year almost everyone was bullish about the prospects for the “reflation trade” of higher bond yields, stock prices and the dollar, driven by rising wages and Donald Trump’s tax-cut plans.

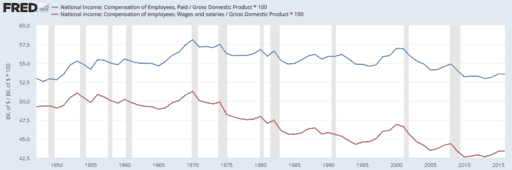

A year on and inflation hasn’t materialized, the tax discussion is bogged down in Congress, and almost every analyst was wrong.